Strategic investor messaging

that moves markets.

Potentia Advisory is a high-touch investor relations advisory boutique specialized in helping publicly listed and pre-IPO companies attract top-tier investors and sustainably improve their market valuations.

Investor-minded IR strategists unlocking your company’s true value

As former equity research analysts and hedge fund investors, we understand firsthand the subtle narrative elements that make institutional investors interested in acquiring shares in a company. Our expertise is to translate complex financials into compelling equity stories that drive investor conviction and long-term shareholder value.

Our areas of expertise include:

-

Equity storytelling

-

High-stake investor messaging

-

Shareholder acquisition

-

Investor sentiment analysis

-

Capital markets positioning

We serve an extensive array of clients around the world, from pre-IPO growth-stage companies looking to maximise their valuation to $80B+ large-cap listed companies seeking advice on high-stakes capital markets matters. Most of our clients are listed on North-American stock exchanges (primarily Nasdaq and NYSE) and European stock exchanges (Euronext, CAC40).

Our sector expertise include:

-

Technology

-

Industrials

-

Media & Telecom

-

Consumer Goods

-

Healthcare

-

Mining & Natural Resources

-

Renewable Energy

We help high-potential listed companies get the market recognition they deserve

Investor Deck

Creation

Create investor decks made to capture the interest of investors and turn them into long-term shareholders.

Investor Q&A

Prep

Prepare executives for investor Q&A sessions, roadshows, and other key IR events to maximize investor confidence.

Investor Acquisition Campaign

Help companies secure new shareholders by increasing their market visibility and connecting them with suitable investors.

“All Weather” IR Advisory

Provide ongoing strategic advice on all aspects of investor relations, ensuring optimal communication with investors in any market conditions.

Our work in numbers

100s of millions

of incremental market cap created.

34% average increase in trading volume

within 4 months of collaboration.

Helped

73%

of clients

outperform industry valuation benchmarks post-collaboration.

100% of CEOs

would recommend our services to other companies.

89%

of clients

listed on Nasdaq, London Stock Exchange, or Euronext.

Want to improve your market traction? Get in touch with us

What we’ll cover:

-

What may be holding your stock back - from visibility to narrative clarity

-

Quick wins to improve your current investor deck and drive stronger engagement

-

Any questions you have around investor perception, positioning, or capital markets strategy

Investor Deck Creation For A $200M Nasdaq-Listed SaaS Solution Provider

Investor Deck Creation For A $200M Nasdaq-Listed SaaS Solution Provider

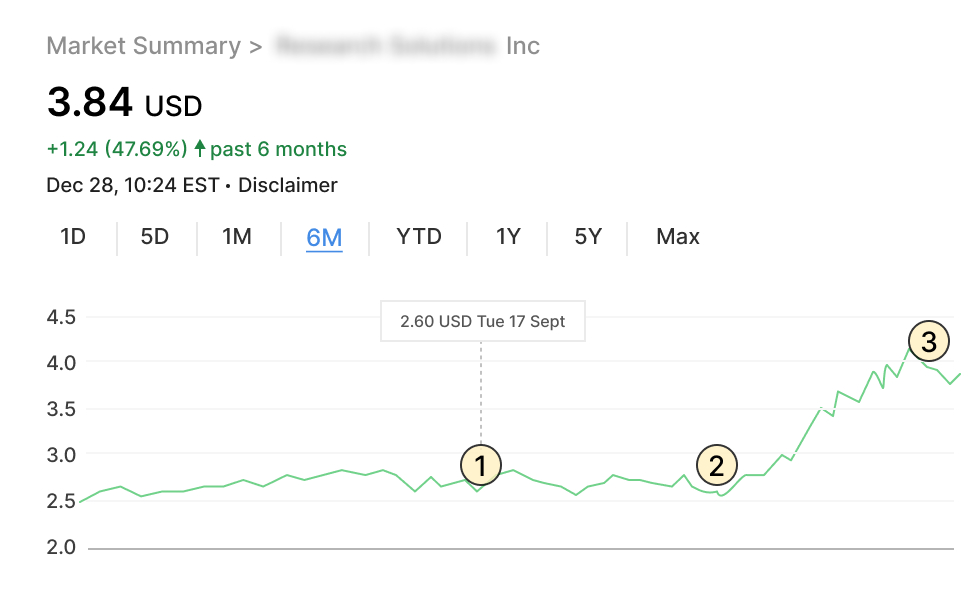

Despite strong operational performance and consistently exceeding expectations, the company's stock price had stagnated for years between $2 and $2.6 per share. The CEO struggled to understand why investors weren’t recognizing the company’s value.

- The investor presentation was overly technical and failed to simplify their technology for investors.

- It lacked robust economic data to showcase competitive advantages clearly.

- Too much emphasis was placed on the product, rather than its ability to generate cash flows and add shareholder value.

- Created a 23-slide investor presentation emphasizing the company’s equity story and competitive strengths.

- Conducted in-depth market research over two weeks to provide compelling data for the deck.

- Collaborated with a top-tier designer to ensure the presentation was visually engaging and optimized for investor appeal.

- +48% market cap increase in 4 months.

- 2 additional sell-side coverage analysts from tier-one brokers.

- Significant growth in institutional shareholder base.

Outcome for the client: +48% market cap Increase in 4 months

September 24:

Beginning of our collaboration. Stock price: 2.60 USD

November 24:

New investor deck unveiled for the first time during major investor event.

December 24:

4 months later, the stock price reached 3.80 USD, a +48% increase.